Qualified Opportunity Zone Program

The OZ program is a highly flexible tax deferral and permanent tax savings (tax deferral vs tax deductions) program available to individuals and entities that have recognized capital gains. All or a portion of the deferred capital gain, rather than the total proceeds, must be reinvested into a Qualified Opportunity Zone Fund (QOF) within 180 days of recognizing the capital gain from the sale of an asset. A QOF is an investment vehicle set up specifically to invest in eligible properties in Opportunity Zones.

The three main benefits include (a) the deferral of original capital gain until the interest in the QOF is sold or on December 31, 2026 (whichever comes sooner), (b) an increase basis adjustment resulting in a 10% exemption of capital gains tax on the original capital gain after 5 years, and (c) the 100% exemption on any post-reinvestment gain (the new capital gain) after the 10-year mark.

The most appealing feature of the OZ program is (c), if the investor keeps their QOF investment for 10 years or more, then they would not owe any tax at all related to its appreciation during the 10+ year hold.

Another major benefit of the Opportunity Zone program is that there is no depreciation ‘recapture’ if the taxpayer holds on to their QOF investment for at least 10 years. This is in stark contrast to traditional investments such as the Internal Revenue Code (IRC) Section 1031 (1031) transaction where you still have to account for Section 1250 and Section 1245 ordinary gain recapture. The positive cash flow effects of this highly sought after feature can be amplified by utilizing an accelerated depreciation cost segregation study

Qualified Opportunity Fund (QOF)

A QOF is an investment vehicle that invests a certain percentage of its cash assets in Qualified Opportunity Zone Property (QOZP). The percentage threshold varies depending on how investments are structured, but a minimum of 63%+ and generally 70%+ is considered ‘playing it safe’.

Unlike the 1031 exchange program that has long been used to defer real estate-related capital gains, a QOF can accept capital gain profits derived from almost any investment, including capital gains from real estate, stocks, bonds, sale of business or business assets, as well as gains made from the sale of personal assets such as art and other collectibles.

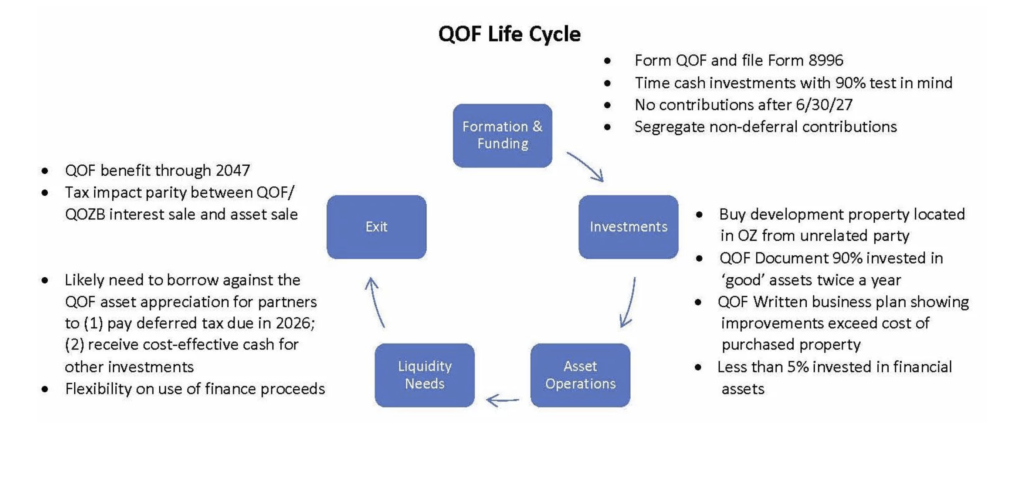

A QOF has up to six months after certification to ‘drop-down’ 90% or more of the cash and property held in the QOF into a ‘QOZB’ subsidiary (a two-tier structure), which can then allow an additional 31 months for re-investment and deployment of the QOF’s assets into a real estate project.

Investments into a Qualified Opportunity Fund do not need to be only made with capital gain profits. A QOF can pool eligible capital gains funds alongside non-capital gain profits, equity and/or debt. Furthermore, QOF investment flexibility allows an investor to rollover only a portion of their capital gain profits into one or multiple QOFs. Unlike a 1031 “like-kind exchange,” a QOF investment does not need to be made for “like kind” in value or asset class.

Urbanist’s Captive QOF and Small Syndicate QOF

Urbanist offers capital gains investors the unique opportunity of a single-purpose QOF structure. Urbanist has arranged for DLA Piper (one of the world’s preeminent law firms) to establish individual or small private syndicate QOFs for its Buyers and Investor clientele, including a personal consultation with the law firm’s Opportunity Zone partner. Furthermore, one of the nation’s foremost Opportunity Zone accounting experts, HCVT, can provide a streamlined accounting and reporting package for the duration of the QOF’s existence. Urbanist makes this unique service possible without the cost and friction generally associated with the setup of this type of sophisticated asset ownership structure, thus allowing investors to maximize their capital gains and tax deductions in their own single-asset Captive QOF.

Perhaps the most unique characteristic of Urbanist’s small balance multifamily (SBMF) product offering, is that it provides investors and real estate asset buyers with a combination of the majority of the benefits of both an IRC Section 1031 exchange and an Opportunity Zone investment, while avoiding or reducing many of the respective pitfalls.

In particular, a related collection of troubling drawbacks inherent to most pooled Qualified Opportunity Zone Funds have been blamed as the reasons why some of the largest QOFs have met only 15% of their capital raise projections—namely the loss of direct ownership control, and being ‘handcuffed’ to a minimum 10 year timeline investment. Larger Pooled Funds QOF investors have little to no influence or control over their investment in relation to income, cashflow or having any say on exit timing, thus the timing of when their original capital gain investment and related profits may be returned is at the behest of the fund’s manager, regardless if the investor requires access to their own funds for both tax planning and cash flow purposes. Urbanist Opportunity Zone Projects sold to an individual investor’s own Captive QOF overcome these inherent challenges faced by larger pooled QOFs.

In October 2019, TRD International reported, “According to an analysis by Novogradac, a San Francisco-based accounting firm, 103 Opportunity Zone funds have raised just 15% of what fund managers expected. Scaramucci’s $3 billion Opportunity Zone fund is now $300 million. And he has only raised $30 million [1%] for it.”

The majority of QOFs are either blind pooled funds for a number of unidentified projects, or pooled funds for specific project(s). In both cases, there are a number of undesirable characteristics to capital gain investors of having their money tied up for at least 10 years, including the fact that a larger real estate development project may easily run 15 years in total duration (including development/ entitlement process, project hold time, and disposition) if market timing isn’t favorable to exit for the fund’s manager.

Investors in these types of projects are at a significant disadvantage, ceding all control and decision making to the fund’s manager, including decisions regarding development, leverage, management, distribution of rental cashflow, and the ultimate exit and asset sale event, while purely relying on the expertise and motivations of the fund’s manager to be consistently aligned with their own, for a period of at least 10 to 15 years. Thus, inherently this process can feel like a precarious and risky proposition for potential investors. There have already been many recorded instances where QOF promoters have abandoned planned projects and are considering liquidating all or a portion of their investors’ funds – thereby negating the deferral and future gain exemption and possibly incurring a loss for its investors in the process, thus significantly compounding their investors’ losses and ‘pain’. These are just several key factors which may correlate to the low capital raising results reported by the larger QOFs.

Additionally, in contrast to the accounting which would be required within a large pooled fund to correctly divide and distribute accelerated depreciation tax benefits to its numerous investors—almost certainly too complicated to happen in practice—for Buyers of Urbanist’s SBMF buildings, held in a Captive QOF structure with only one owner or small syndicate, the accounting is not too challenging.

Cash-Out Refinance

By establishing a Captive QOF, a capital gains investor may take the unique advantage of the ‘disguised sale rules’ to procure a cash-out liquidity event by refinancing the property any time after a two year hold period. Never before has an investor been able to sell an asset and realize a capital gain profit, withdraw their original principal and reinvest the capital gain into a new property which they wholly own, then utilize up to 75% of cash from the original capital gain shortly after reinvestment with no negative tax implications, while still retaining all the tax deferment as well as the considerable additional Opportunity Zone tax exemption advantages.

Whether an investor currently has only a few hundred thousand dollars or substantially more in capital gain profits, Urbanist can assist them in establishing their own Captive QOF, invest in or purchase a brand new Class-A+ SBMF Building in a rapidly appreciating submarket of a top tier city, and cash-out up to 75% of their original capital gains profit after only 2 years, to utilize or spend as they please.

Typical QOF Fees – “Death by a Thousand Cuts”

By controlling one’s own Captive QOF, an investor can save considerable fees which may be charged by Pooled QOF Funds, such as large upfront offering charges, origination/acquisition fees, yearly asset management fees, various other ‘junk’ fees, along with a portion of any potential future profit which they may have to share with the fund manager.

The majority of large ‘public’ QOFs have high fees ranging from 1% to 2.5% in annual asset management fees coupled with ‘carried interest’ ‘waterfall’ structures in the 15%-30% range, with some charging an additional 2%-6% in project acquisition fees – which are on top of their third-party legal, accounting and other professional fees. This creates a very high hurdle for investor profitability which may be hard to achieve even in 10 years, if at all.

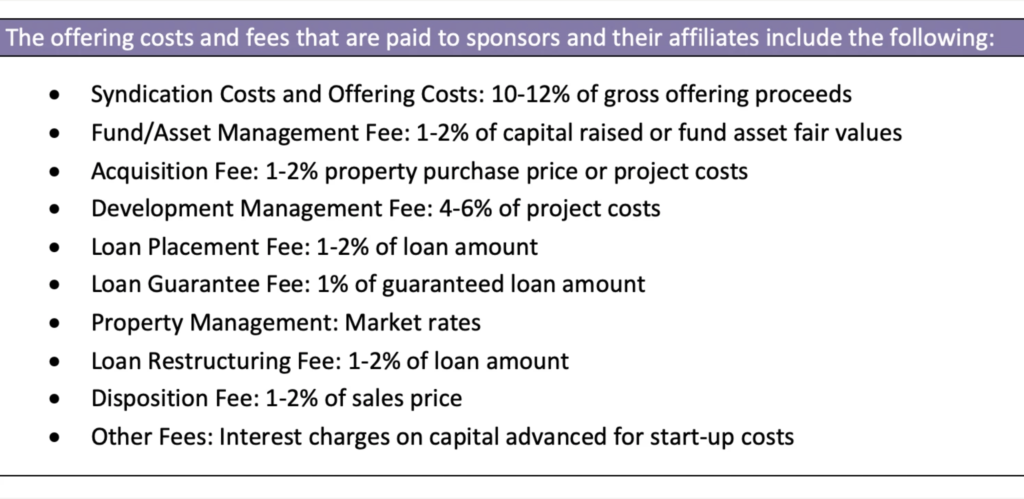

Singling out just one of the ten fee line items charged to investors by fund managers listed below in Mick Law P.C.’s article, a yearly management fee of only 1-2% of the fund’s asset value on a $25 million property equals $250,000 to $500,000, which is a large portion of the property’s annual net operating income. This is not to be confused with the property management expense which would be paid out of the rental income. The annual asset management fee is only for asset management at the fund level.

Based on a 6% Cap Rate, and after accounting for debt service, the fund’s management fee alone may wipe out the investors’ entire net cashflow, which is why so few larger pooled funds actually pay out any dividends or any meaningful cash flow distributions to their investors. Many investors in pooled QOFs have to ‘wait and hope’ that their pooled asset appreciates in value to such a degree, that they can ultimately receive their original investment back, and hopefully with some appreciation profits, when the disposition of the property takes place in 10 to 15 years.

Urbanist offers no fees whatsoever for individual Captive QOF and for small private syndicated QOFs of which Urbanist is a long term equity partner.

Pooled Qualified Opportunity Funds – Death By a Thousand Cuts

“Despite the hype surrounding the QOF’s tax benefits, the threat for an investor to “suffer a death from a thousand cuts”must be taken seriously when reviewing the various fees associated with the first generation of QOFs. While certain of these fees are also charged in programs outside of the QOF arena, almost all of these fees appear to be making their way into the structures of the QOFs we have seen in one form or another.”

– Summer 2019: AI Quarterly Qualified Opportunity Zone Funds Program Economics, Mick Law P.C